Stockscurrent Team | Mar 24, 2023 |

There are multiple ways to manage cash, but recent news of troubling banks causes a lot of panic and uncertainty. When you deposit money to any bank please make sure they are FDIC(Federal Deposit Insurance Corporation) insured. More you also need to know that FDIC only covers up to $250,000. Any amount above $250,000 is considered an uninsured deposit you have to be carefully managed. Recently Few members reach out to us about how to buy US Treasury Bills(T-bills). Remember Warren Buffett buys US Treasury Bills frequently as part of his cash management and fixed income strategy.

US Treasury Bills are relatively safe and do not depend on any Bank. More it's the amount you can buy up whatever amount that you need, and you don't need to buy any additional insurance to protect your deposit. So you are mitigating the risk of banks failing, an FDIC limit of $250,000, and earning interest on your capital. There is still a slight risk if something goes wrong with the US treasury, it will be less likely chance and too big of a problem, and at that point, everyone in the US will be worried. This is a common practice to buy Treasury Bills as part of cash management. It has a fixed yield, and time duration and that will be your fixed income for that time duration, in other words, that's your coupon. There is a slight tax advantage, Interest from Treasury bills is subject to federal income taxes but not state or local taxes.

You can directly buy the Treasury Bills from the US government site, in that case, there is no risk of any financial institution or bank going bankrupt.

Here is the link to check the Treasury bill rate AKA coupon rate. https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_bill_rates&field_tdr_date_value_month=202308

Step1:

Go to the US government site https://treasurydirect.gov/

For the first time only, Create your Account

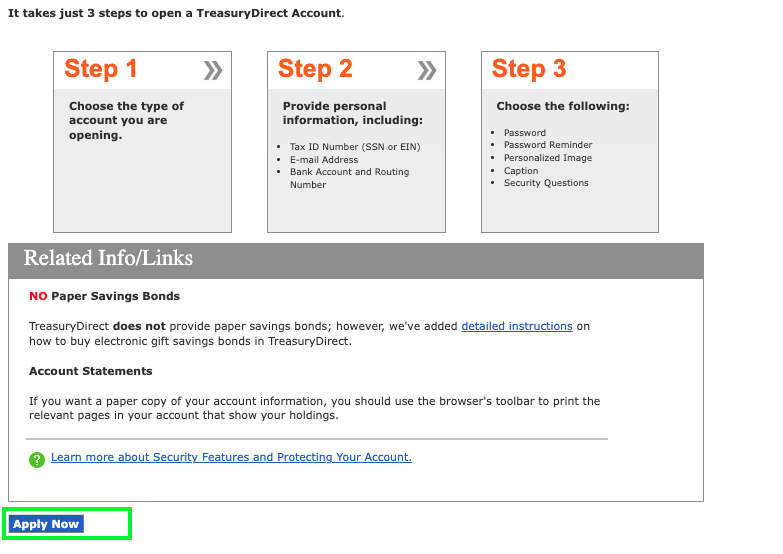

Click on the "Apply now"

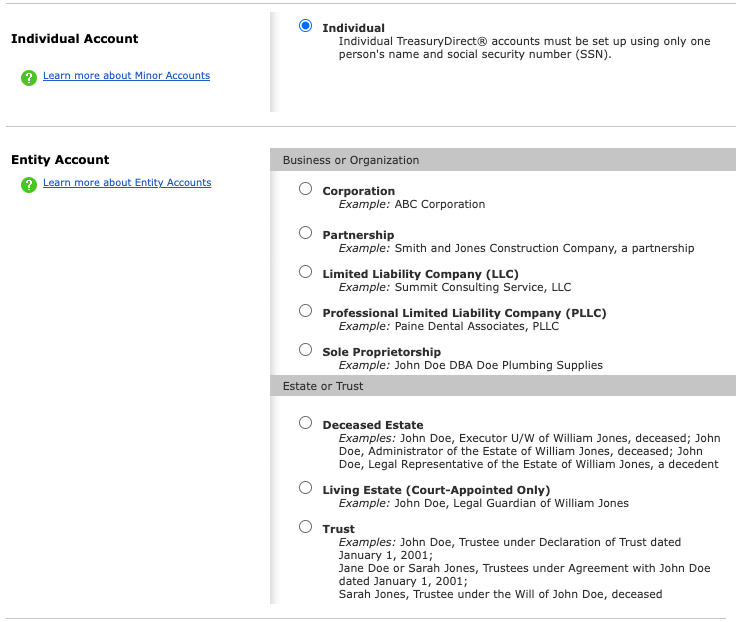

Choose the "Account type". Good thing is Any size of company can also buy the US treasury bill as part of their cash management strategy.

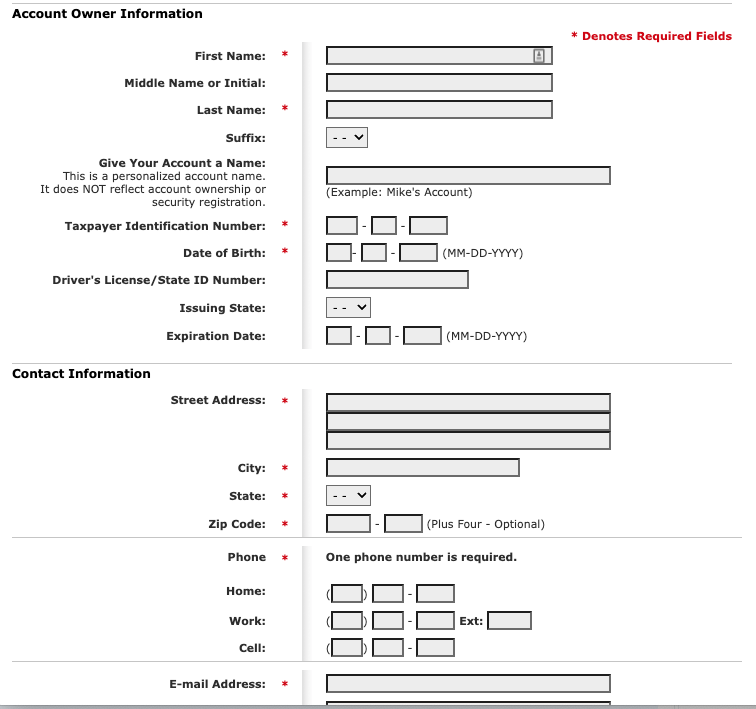

Fill out the Account information

Step2:

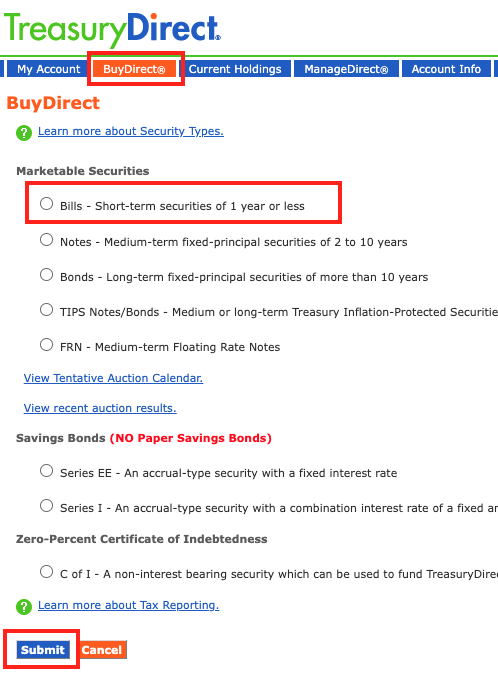

Once you create your Account, pleae log into the account. Then go to BuyDirect on the top menu, then choose the Bills - Short term securities of 1 year or less option

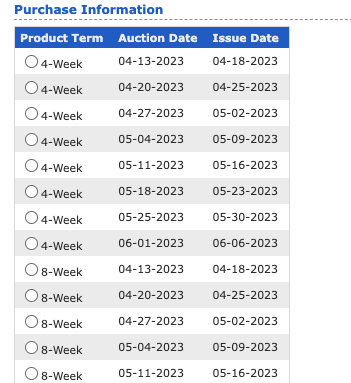

You will be able to see term, Select the term that you like

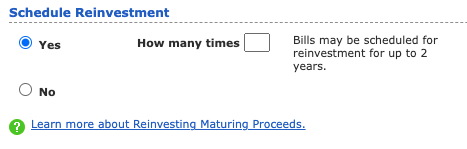

If you want to automatic reinvetment at the time of maturity then select "Yes" otherwise select "No"

We are not recommending or suggesting buying only treasury bills as part of the cash management, it's good to know when to buy and how to buy treasury bills. If you like the article please join Stockscurrent you will get access to our recommendations, watchlist, and real-money portfolio. You will receive real-time mobile notifications and email alerts of our activities in the real-money portfolio.